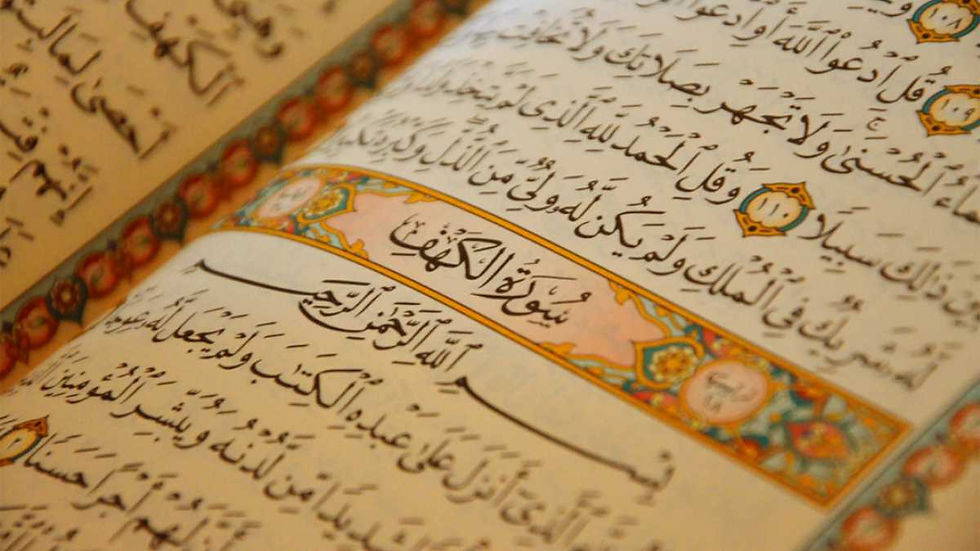

Under the most traditional interpretation of zakat use, Muslim scholars have ruled that institutions serving Muslims like schools and mosques are not eligible to receive zakat as one of eight recipients recognized in the Qur’an. Over the last century, contemporary scholars (e.g., Yusuf Al-Qardawi) have argued that, in the context of nations where Muslims are not the majority, such institutions can qualify for zakat. While the Qur'an and Hadith do not explicitly mention supporting Islamic schools in non-Muslim lands, the principles and purposes of zakat, as outlined in Islamic jurisprudence, support the idea that zakat can be used for activities that

preserve and promote the faith, knowledge, and well-being of the Muslim community, especially in non-Muslim countries, as long as it adheres to the broader principles and objectives of zakat. Contemporary scholars argue, for example, that one of the primary purposes of zakat, as stated in the Qur'an (Surah At-Tawbah, 9:60), is to support those "whose hearts are to be reconciled". In non-Muslim countries, where Islamic identity and faith can be challenged, Islamic schools play a crucial role in preserving the religion of Muslim children. Supporting these institutions helps in reconciling their hearts to Islam by providing a safe environment for religious education. Additionally, zakat is also used "in the way of Allah” which can be interpreted to include various charitable purposes aimed at religious development in non-Muslim nations. Supporting Islamic schools can be considered a legitimate way of spending zakat because it contributes to the religious and moral development of Muslim children, ultimately benefitting the wider Muslim community. Recognizing the need to remain religiously rooted while also acknowledging the varying interpretations of our donors, the Academy’s policy sits in between the traditional and contemporary opinions on zakat use. We accept zakat funds only to support tuition for students identified as needing financial aid, and not for any other institutional expenses (e.g., staff salaries, curriculum materials, building costs, etc.). Recipients of financial aid may not, however, necessarily qualify as recipients of zakat under the traditional interpretation (e.g. the poor who cannot meet basic needs (fuqara) and the needy who have limited means to support themselves (masakin)). The Academy’s policy for financial aid is more inclusive and accounts for a myriad of factors that are largely self-reported by families: income from the 1040 tax form, family size, number of students enrolled in Al-Hamra, qualification for free/reduced-price lunch, tuition for the present year, and how much each family would be able to pay yearly. Yet, without this financial aid support, these students would not be able to attend Al-Hamra, as the Academy typically is unable to collect sufficient funds through general donations to cover these costs (i.e., sadaqah). Under circumstances that the amount collected for zakat purposes in a given year exceeds the costs necessary to cover financial aid for that particular school year, the Academy will hold on to those funds to use for the following year. Excess zakat funds will not be used for any purpose other than for the tuition support described above.